Benefit from simplifying your day-to-day business activities

Increase productivity

Work more efficiently and effectively with effortless collaboration, flexible workflows, personal dashboards, and custom automation.

Partner with experts

Set your practice up for success, working with a skilled team that’s been at the forefront of chambers management innovation.

Future-proof technology

Ensure the longevity of your solution—Opus 2 Chambers (LEX) is state-of-the-art software with continually improving capabilities.

Our tailored solution improves your legal service delivery

Developed by a team with decades of experience in barristers’ chambers, we offer fully customisable software for chambers, stables, lists, and other advocates that drives efficiency and innovation—so you can focus on delivering superior value to clients.

Billing

Marketing

Scheduling (diary)

Reporting

Billing

Successfully managing a chambers business requires highly organised, synchronised processes that ensure the entire team is on the same page. Nowhere is that more apparent than in the financial areas of your multifaceted operation.

From generating quotes and agreeing costs to tracking expenses and chasing fees, Opus 2 Chambers (LEX) incorporates easy-to-use billing and other accounting software features right into your workflows. You’ll increase visibility, transparency and efficiency while improving and accelerating payment processing.

Marketing

The most successful legal organisations have obvious things in common—talent, experience, integrity, results, and other qualities. But without an effective approach to promoting that expertise, knowledge, and performance, it’s difficult to differentiate your services.

Opus 2 Chambers (LEX) offers a suite of marketing tools and templates integrated into our software solution that helps your chambers improve client engagement, nurture prospects, organise campaigns, capture leads, coordinate events, and build a superior brand.

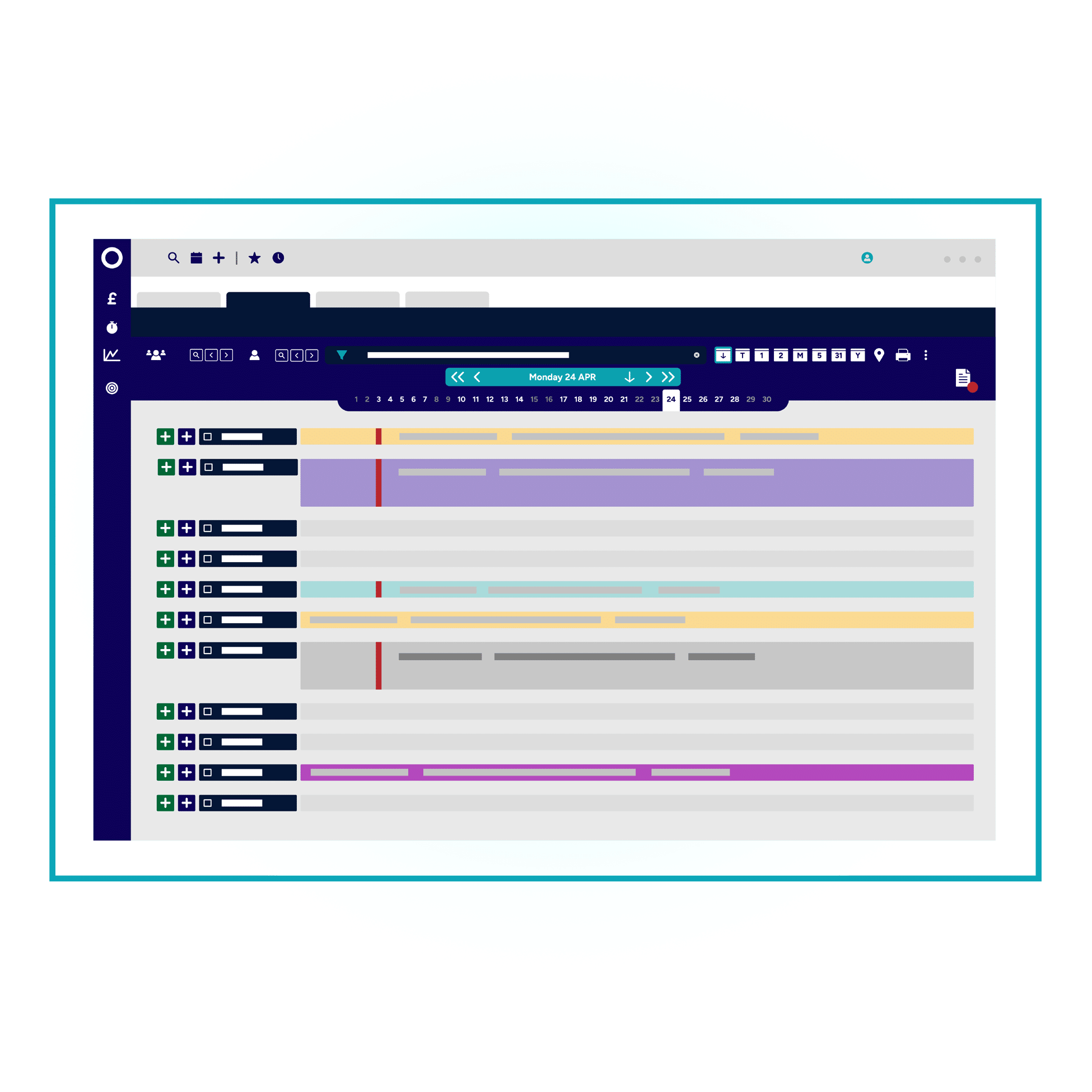

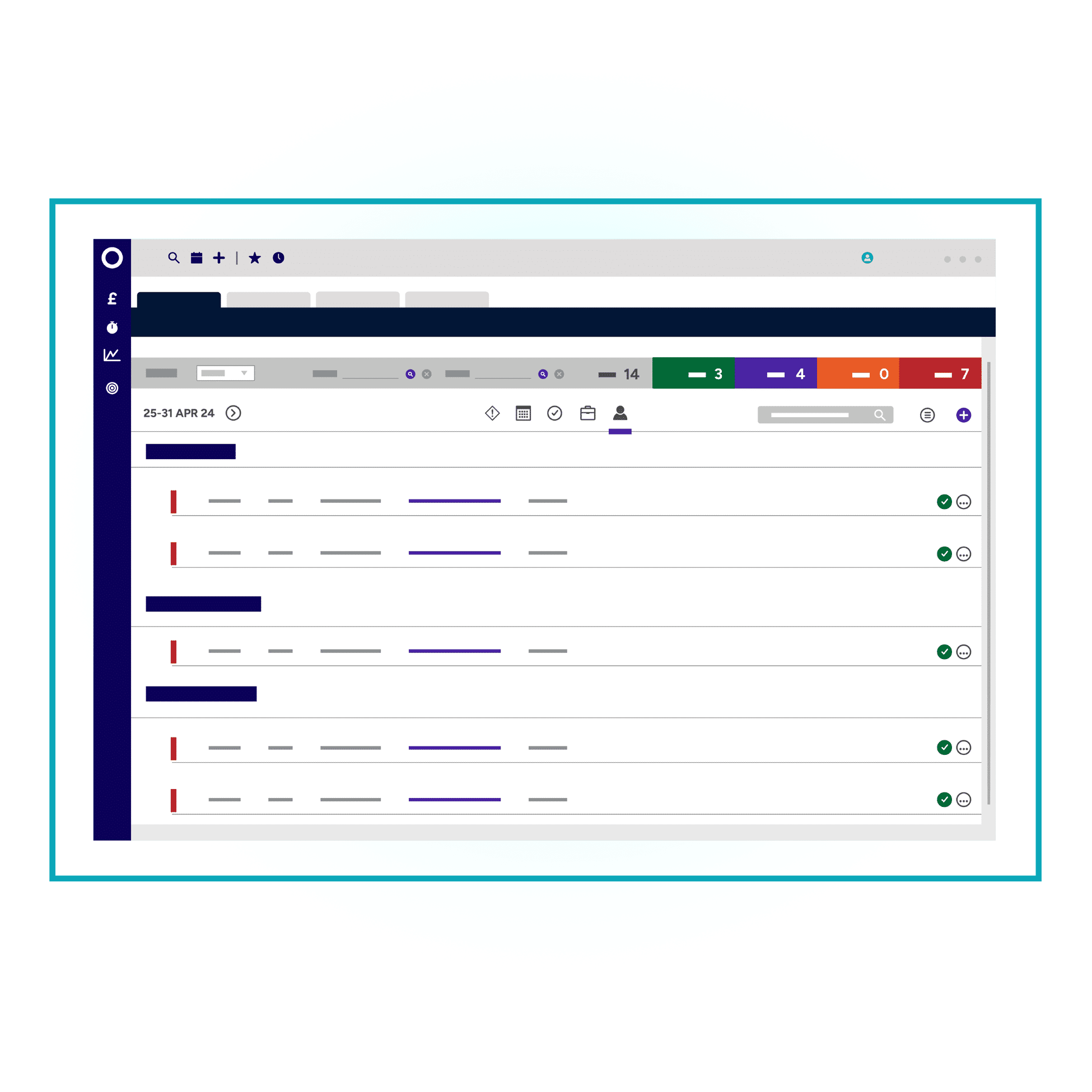

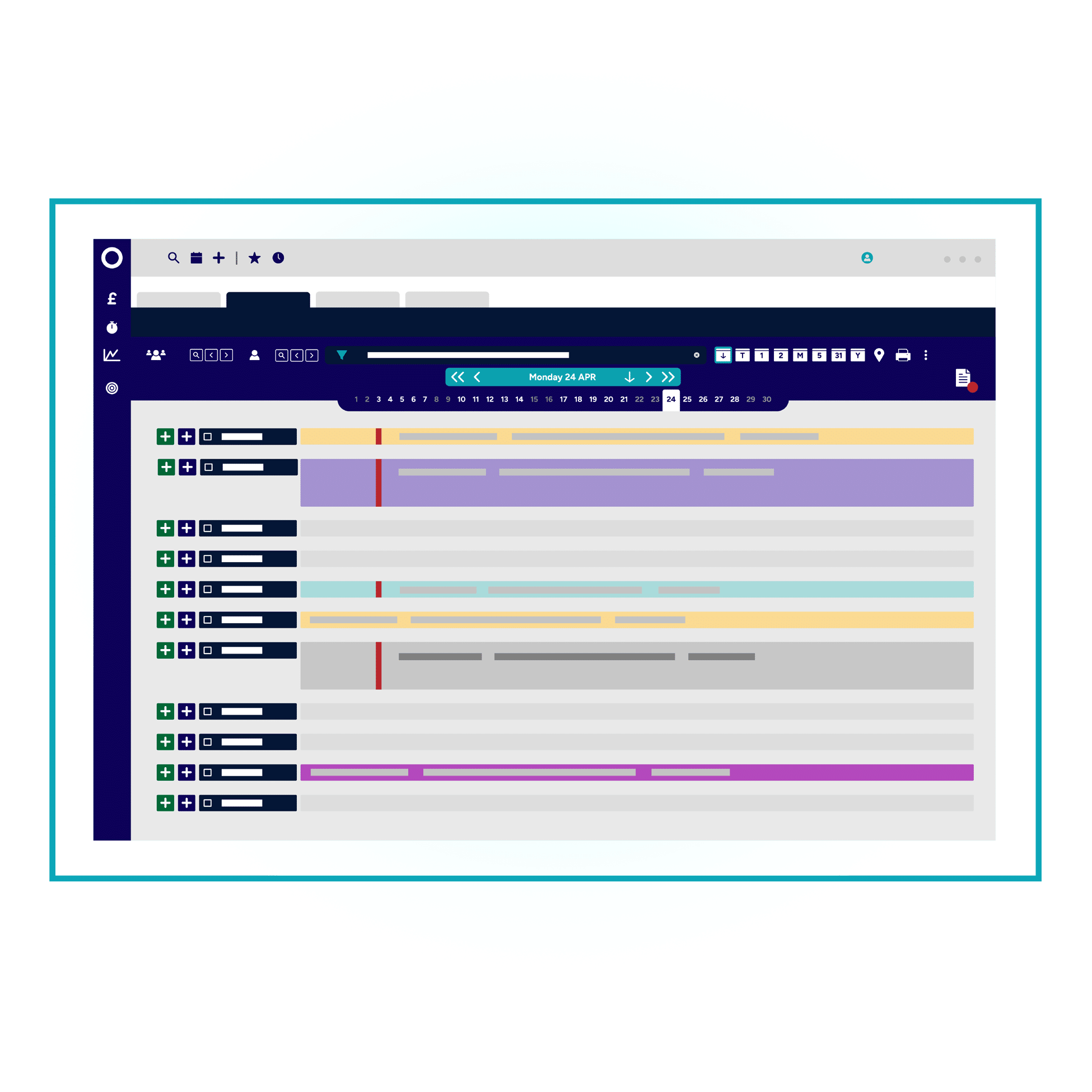

Scheduling (diary)

Operating effectively in a fast-paced, high-pressure chambers environment necessitates a highly organised approach to scheduling. Software that helps clerks stay on top of diaries is essential to better managing the practice and business activities.

With diary management capabilities integrated throughout our solution, you can keep everyone on schedule—setting appointments, organising workloads, providing visibility into agreed fees, and more. Your team can access diaries anywhere, anytime and synchronise diaries with external calendars.

Reporting

When multiple departments are using different tools to manage diaries, finances, marketing, communications, and other functions, inefficient processes follow. A key reason is that disconnected systems make it difficult to measure holistic success.

Because our easy-to-use chambers management software brings everyone together in one, connected solution, you have access to comprehensive reports and dashboards that show the complete picture—barrister performance, fee analysis, completed work, marketing trends, and more.

All the capabilities you need to modernise your practice

Packed with features, Opus 2 Chambers (LEX) makes it easier than ever to manage your cases, finances, and marketing in one solution—offering everything from diary management to automated billing and fee reporting to prospecting.

Bookings

Easily organise meetings between barristers, clients, and instructing solicitors, keeping track of all pertinent diary details.

Opportunities

Use our diary-based opportunity tracking dashboard to quickly analyse chambers and individual barrister work opportunities.

Invoices/payments

Simplify invoicing, payment matching, fee notes, taxes, currency conversion, and more with comprehensive accounting capabilities.

Reports

Generate detailed reports using more than 30 customisable templates, such as aged debt, payment summary, work done, barrister performance, and more.

Templates

Use our customisable templates to standardise communications, automate case workflows, and perform other time-saving benefits.

Emails/newsletters

Manage large contact lists, build custom-branded emails and newsletters, evaluate email campaign success, and more.

Documents

Easily manage all documents and content in one secure repository and leverage automatic document processing features.

Events

Effectively market your chambers by easily organising events or seminars with our built-in event management functionality.

Dashboards

Visualise important metrics across your business with customisable dashboards that deliver valuable insights at a glance.

Activities

Record business development activities away from the diary, logging contacts, notes, dinners, and meetings with individuals or firms.

Stay connected with legal case management software

Through seamless integration with Opus 2 Cases for counsel, barristers gain more autonomy and control over their whole case portfolio, providing a more efficient way of working on all cases. Clerks can allocate new or existing cases to barristers in Opus 2 Chambers (LEX) who then analyse documents and evidence and prepare their strategy inside Opus 2 Cases.

The result is greater visibility and transparency of barristers’ activities without any additional administrative overhead. It creates and maintains a seamless flow of secure documentation for case preparation across the two systems and can enable easy collaboration with firms you’re working with. Integrating with our case management, analysis, and preparation solution improves efficiency for clerks and is more convenient for barristers.

Connect with Direct Access Portal (DAP) and Digital Case Service

Working in collaboration with the Bar Council, our solution empowers you to automatically synchronise diary information in Opus 2 Chambers (LEX) with individual barrister’s calendars hosted on the Direct Access Portal—the most extensive barrister listing in England and Wales.

We also offer a dedicated, quick-access area where you can link directly to specific cases inside the Crown Court Digital Case System. Legal professionals use the Digital Case System to “share information with court staff, the judge, and the prosecution or defence, and collaborate on documents and the bundle.”

We ensure everyone is on the same page

When work is as demanding as yours, software that can take the pressure of your daily office, marketing, scheduling, and administrative routines provides tremendous value. We designed Opus 2 Chambers (LEX) to do just that—streamlining your practice by bringing your barristers or advocates, clerks, administrators, and marketing staff together with tools that simplify their daily work activities.

Clerks

Clerks

Advocates

Advocates

Administration

Administration

Marketing

Marketing

Clerks

Crucial to the success of individual members and business as whole, we designed our solution to ensure clerks are successful too—helping them deliver flawless administrative and business support.

Advocates

Because barristers and other court advocates often face tight deadlines, heavy workloads, and long hours, our solution only introduces purposeful and valuable features that simplify their routine, not complicate it.

Administration

From human resources and accounting to support and administration, our solution facilitates better collaboration and more efficient processes to keep all areas of the business running smoothly.

Marketing

Our solution makes it easy for marketers to promote events, communicate with prospects, build stronger relationships, manage vendors, and elevate the organisation’s reputation with best-in-class tools.

Executives

As with any successful business, CEOs and other chambers executives need comprehensive data to make important decisions—our integrated solution offers them a range of valuable reports and dashboards.

Our chambers management experience matters

Worldwide chambers, stables, and lists use Opus 2

Find out how to improve your legal service delivery and client value with chambers management.